Kanga Potash is looking to fast track its fertiliser project in the Republic of Congo into production with early works starting early next year and commissioning planned for2025 for an initial production capacity of 600Ktpa of Muriate of Potash (MOP).

Kanga Potash Project

Location: approximately 32km NW of the Republic of Congo’s (RoC) second largest city Pointe-Noire.

Investment Highlights

Potash Market

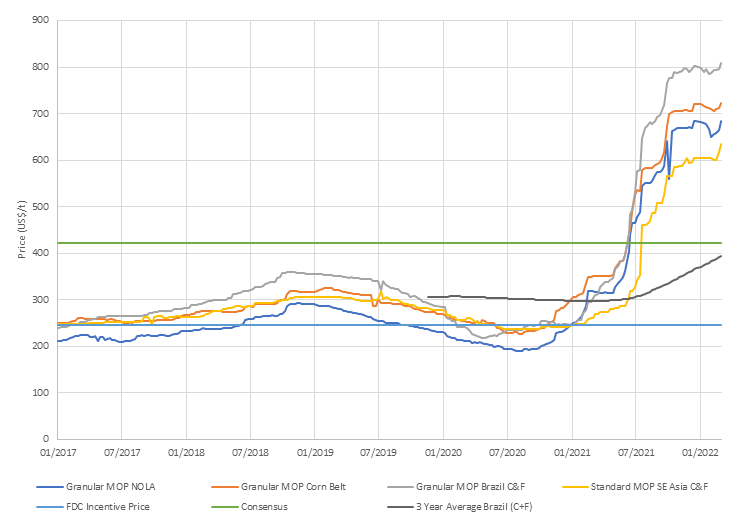

· Approximately 40% of Global Productive come from Russian, Ukraine and Belarus. Secure supply is now a critical for food security

· CIF Brazil spot is currenlty US$808/t. 3 year Average no US$394/t

Huge Resource

· Two licenses with c. 12B and c. 13B tonnes of potash resources

· Ultra thick carnallite seams of +/- 210m

· Scalability on a huge resource with 30 years LOM

Logistics Advantages

· Plant and solution mining on the Atlantic coast (ex mine = FOB)

· Long and expensive logistics to the port of export avoided

Proximity to Key Potash Markets

· Shortest hipping time to major Brazilian and developing African markets

Competitive costs

· Attractive CAPEX: $457m (600K tpa)

· Globally lowest FOB cash cost: $53/ton (2.4M tpa) and $66/ton (600K tpa)

· Low sustaining CAPEX as cavern life is in excess of 20 years per well

Robust Economics

· For all investigated production scenarios compelling results

· 600K tpa: post tax NPV(12.2) $501m, post tax IRR 22.3%, av. EBITDA of $139m/pa at full capacity2)

· 2.4M tpa: post tax NPV(12.2) $1.9b, post tax IRR 21.3% and an av. EBITDA of $618m pa2)

Off-take MoUs Signed

· Kanga Potash secured two Letters of Intent from reputable trading companies for 100% of the designated production

The company is seeking to undertake pre-IPO financing ahead of listing on the AIM market in Q4 2022.

Pre-IPO Offering

· Strong support from current shareholders: AMED Funds, SMI and Baker Steel Trust Resources

· $43M invested over $5 years.

· The latest capital raise at $80 per share valued the Company at $68M

· Pre-IPO Raise: $3M-$5M (with potential to take up to $10M) at the lower of

o (1) 20% discount to the IPO Share price, or

o (2) $99 per share ($84m pre-money valuation)

· FDC and Liberum are expected to co raise $15-$30M for AIM IPO in Autumn 2022.

· The Kanga project is expected to become one of the lowest-cost producers globally within 3 years, with first production 25/26.

For more information, please feel free to contact MiningComm Platform.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

Kanga Potash

Kanga Potash  Return

Return MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province