Vancouver, BC / TheNewswire / December @, 2022 / Global Energy Metals Corporation TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1 (“Global Energy Metals”, the “Company” and/or “GEMC”), a company involved in investment exposure to the battery metals supply chain, announces that it intends to reprice an aggregate of 13,506,500 outstanding common share purchase warrants (“Warrants”) issued pursuant to three private placements that closed September 2020, May 2021 and March 2022 with Warrant expiration dates in September 2023, May 2024, and March 2024 (the “Warrant Amendments”).

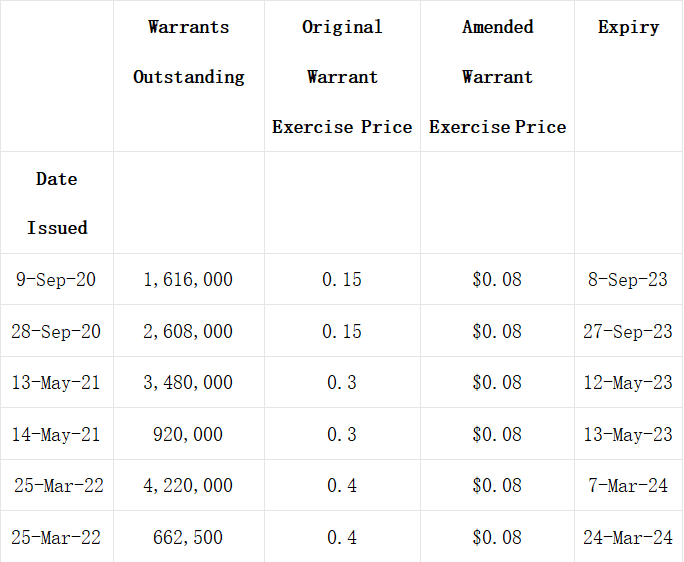

The following is a schedule of the Warrants that are proposed to be repriced to $0.08:

The Company believes that the repricing of the amended Warrants is reasonable and necessary in the context of the overall market, as it increases the likelihood that any near term additional cash needs of the Company could be financed through the exercise of the amended Warrants.

The Warrants as amended, will be subject to an accelerated expiry provision such that if, for any 10 consecutive trading days (the “Premium Trading Days”) during the unexpired term of the Warrants, the closing price of the common shares (“Common Shares”) exceeds $0.10, representing the amended Warrant exercise price of $0.08 plus 25%, the exercise period of the warrants will be reduced to thirty (30) calendar days (the “Acceleration Clause”). The Company will announce any such accelerated expiry date by press release, and the 30‐day period will commence 7 days after the last Premium Trading Day. All other terms of the Warrants remain unchanged.

Any insiders of the Company who participated as to more than 10% in the financing in which the Warrants were issued will be subject to a limit of 10% of their holdings being repriced on a pro rata basis in accordance with the policies of the TSX Venture Exchange (the “Exchange”). All other terms of the Warrants remain unchanged.

The Warrant Amendments are subject to acceptance by the Warrant holders and approval of the Exchange (the “Warrant Amendment Approval”).

The Company also announces that if it obtains Warrant Amendment Approval, the Company will institute a warrant exercise incentive program (the "Incentive Program") designed to encourage the early exercise of 13,506,500 Warrants. Under the Incentive Program, the Company will offer an inducement to each Warrant holder that exercises their Warrants for a period of 30 days from receipt of Warrant Amendment Approval (the "Early Exercise Period"), by the issuance of one additional common share purchase warrant (an "Incentive Warrant") for each Warrant exercised during the 30 day period of the Incentive Program. Each Incentive Warrant will entitle the holder to purchase one additional Common Share for a period of 12 months from the date of issuance of such Incentive Warrant, at a price of $0.15.

The Incentive Program will commence upon receipt of Warrant Amendment Approval and it will expire 30 days thereafter at 4:00 p.m. (Vancouver time). The Incentive Warrants will be subject to a four month hold period from the date of issuance and will include a warrant acceleration provision by which the Company will be permitted to accelerate the expiry date of the Incentive Warrants if the closing price of the Company's Common Shares on the Exchange remains at or above $0.20 for a period of ten consecutive days (the "Acceleration Event"). In the event the Company exercises the Acceleration Event (by disseminating a news release advising of the Acceleration Event), holders will have 30 days to exercise the Incentive Warrants, after which the unexercised Incentive Warrants will be void and of no effect.

The Company intends to issue an updating news release upon receipt of Warrant Amendment approval and commencement of the Incentive Program outlining the terms and conditions and the method of exercising the Warrants pursuant to the Incentive Program.

The Incentive Program remains subject to Exchange Approval.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province