Montreal, Quebec, June 11, 2021 - Aya Gold & Silver Inc. (TSX: AYA) (“Aya” or the “Corporation”) is pleased to announce closing of the previously announced acquisition of Algold Resources Ltd (“Algold”) and an updated mineral resources estimate for its Tijirit Gold Project (“Tijirit”) in Mauritania. All amounts are in US dollars unless indicated otherwise.

Transaction Highlights

Following the close of the Algold acquisition,

Aya controls 100% of Algold and is the 75% owner-operator of Tijirit, with the remaining 15% owned by the Government of Mauritania and 10% by Wafa Mining & Petroleum

Aya paid a total consideration of C$15.2 million which includes an issuance of 2,821,253 Aya shares and payment of C$2.6 million in cash

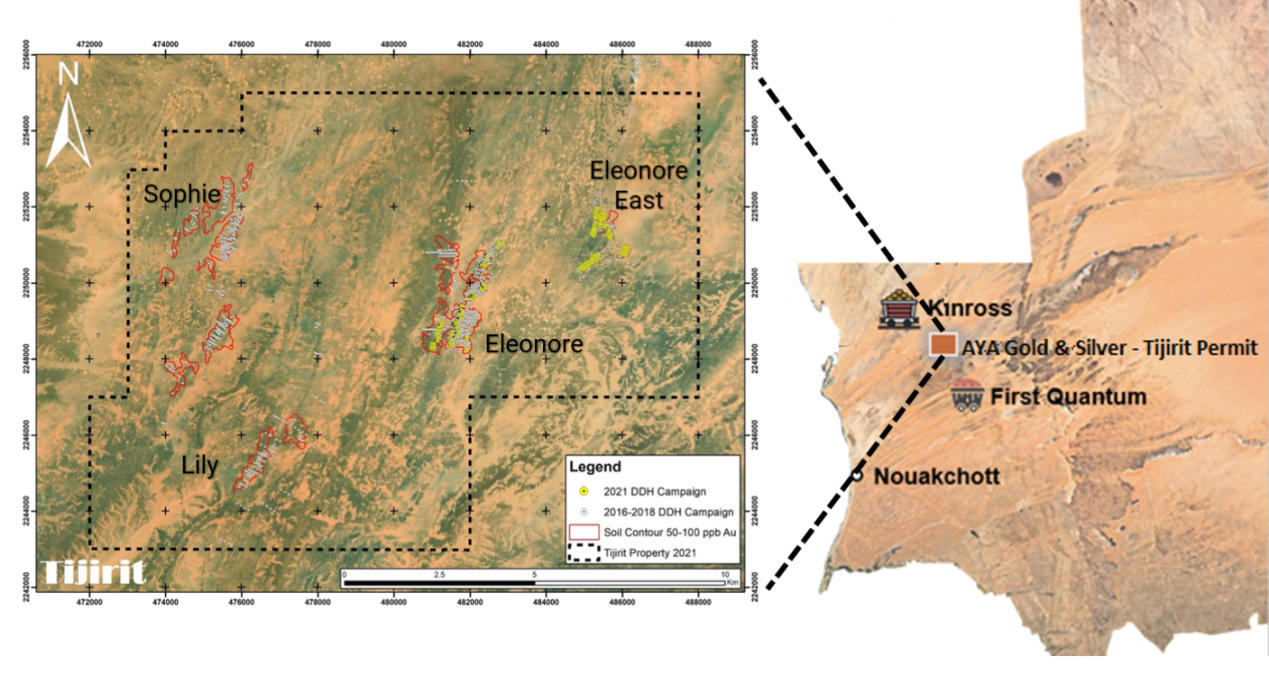

Aya gains a high-grade gold (“Au”) resource project and a 26-year mine permit covering more than 150 km2 in a pro-mining jurisdiction that it knows well

Aya has appointed Thierry Vergnol as President & General Manager for Tirex S.A. Aya’s local subsidiary, and Patrick Perez, as Project Director for Tijirit

Aya has launched a feasibility study (“FS”) to assess the potential for developing Tijirit

Algold shares have been delisted from the TSX-Venture Exchange

Resources Update – as of May 12, 2021

Measured and Indicated (“M&I”) mineral resources for the Eleonore Zone increased by 127% to 214.7 K ounces (“oz”) of Au compared to 94.2 K oz of indicated oz in March 2018

Eleonore deposit remains open along strike and at depth

M&I mineral resources for the Lily/Sophie Zones totalled 77.9 K oz, relatively unchanged from 75.2 K oz in 2018

Lily/Sophie zones remain open along strike and at depth

Transaction Details

Aya paid a total consideration of C$15.2 million that comprised

2,133,333 Aya shares issued to secured creditors

307,294 Aya shares and C$100,000 distributed to Algold unsecured creditors

294,946 Aya shares to Algold common shareholders

85,680 Aya shares and C$2.6 million in payments and advances in the context of the restructuring

The final exchange ratio is 0.010601 of an Aya common share for each Algold share. Algold shareholders will receive the resulting Aya shares without action on their part.

All Aya shares received in conjunction with this transaction are subject to a four-month hold period.

Launch of Tjirit Feasibility Study

Following the acquisition of Tijirit, Aya has launched a FS to assess the potential for developing Tijirit. The following globally recognised engineering consultants have been mandated to complete the FS: Lycopodium Minerals Canada, SGS Canada Inc., DRA Americas Inc., and GCIM.

The FS, which will initially focus on the Eleonore and Eleonore East deposits, is scheduled for completion within the next twelve months and envisages a base case scenario of a 1,000-tonne-per-day (“tpd”) processing plant that can be easily expanded to 2,000 tpd. The proposed initial flowsheet will comprise a conventional primary crush and SAG milling circuit, followed by gravity gold recovery and leaching.

A budget estimate of $5.6 million has been established for the year in conjunction with the Tijirit project. The following activities will take place:

15,000 meters of drilling to convert in-pit inferred resources into the M&I categories and to expand the mineral resource base, scheduled for completion in Q1-2022 (see Figures 1-3)

A metallurgical test work program

All engineering studies for the completion of the FS

All field work programs such as geotechnical and hydrogeological programs

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a publicly traded Canadian company focused on the operation, exploration, acquisition and development of silver and gold deposits. Aya is currently operating mining and milling facilities at its Zgounder Silver Mine, an 85%-15% joint venture between its subsidiary, Zgounder Millenium Silver Mining SA, and the Office National des Hydrocarbures et des Mines (“ONHYM”) of the Kingdom of Morocco.

Its mining portfolio also includes the Boumadine polymetallic deposit located in the Anti-Atlas Mountains of Eastern Morocco which is also an 85%-15% joint venture between Aya and ONHYM. Additionally, the Corporation’s portfolio includes the Amizmiz and Azegour properties, both 100% owned, with gold, tungsten, molybdenum, and copper occurrences in the center of the historical mining district of Morocco, and the Tijirit project located in Mauritania.

Welcome to MiningComm Platform

Welcome to MiningComm Platform

MONTT GROUP

MONTT GROUP EMAIL:service@miningcomm.com

EMAIL:service@miningcomm.com TEL:0512-67629552

TEL:0512-67629552 ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province

ADDRESS:6/F, Block A, Suxin Mansion, No.88, Zhongxin Ave West, Suzhou Industrial Park, Jiangsu Province